White Label Digital Banking Solutions are pre-built financial platforms that businesses can customize with their own brand, design, and features. Instead of building from scratch, they allow quick deployment of services like accounts, payments, wallets, and lending.These solutions save time and costs while ensuring scalability, security, and flexibility, helping businesses enter the market faster with a professional and reliable setup.

Yes. We provide full technical support, maintenance, and upgrades even after deployment. Our team ensures smooth operations through security updates, bug fixes, and performance improvements.We also assist with compliance, scaling, and adding new features over time, so your platform remains future-ready as the market evolves.

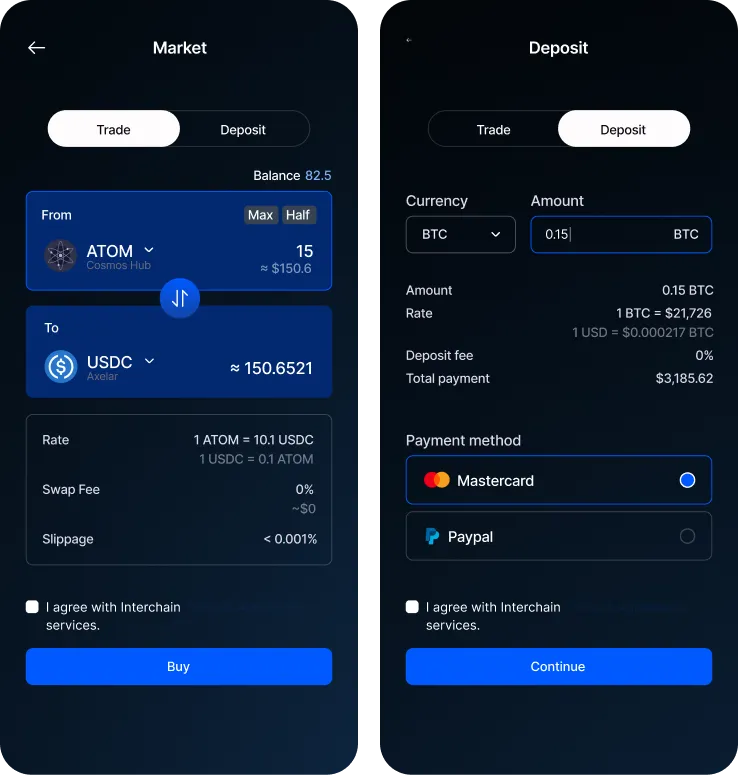

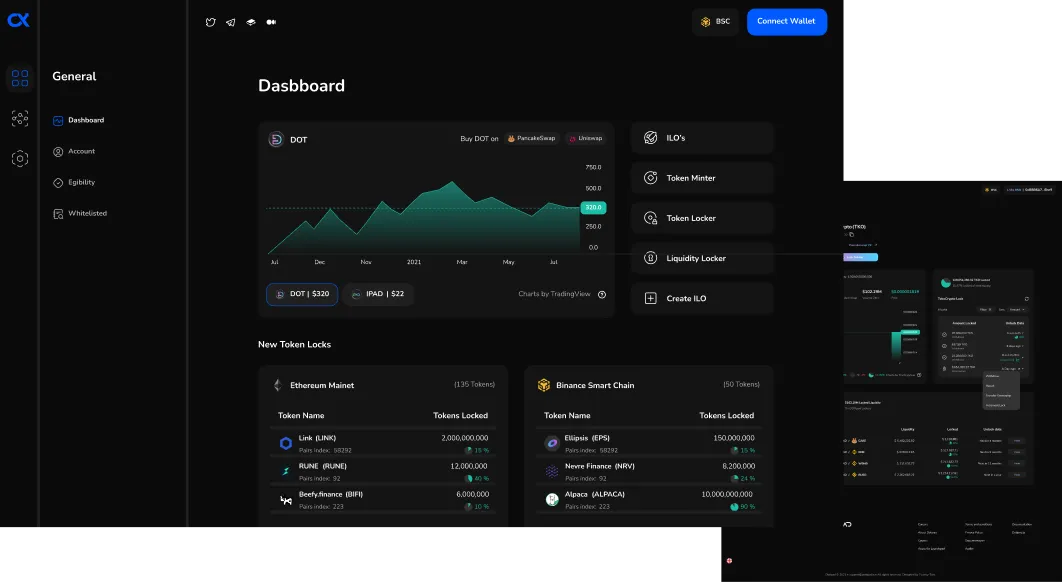

Yes. All our platforms are built with interoperability in mind and integrate seamlessly with core banking systems, ERPs, or third-party payment processors. With API-driven architecture and modular design, the process is smooth, cost-effective, and ensures your existing infrastructure continues working without disruption.

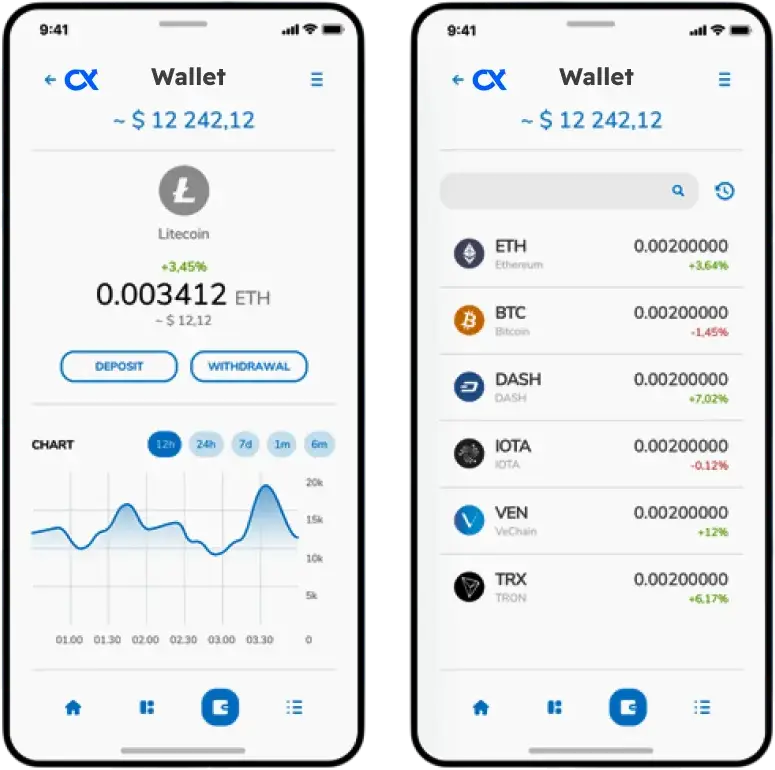

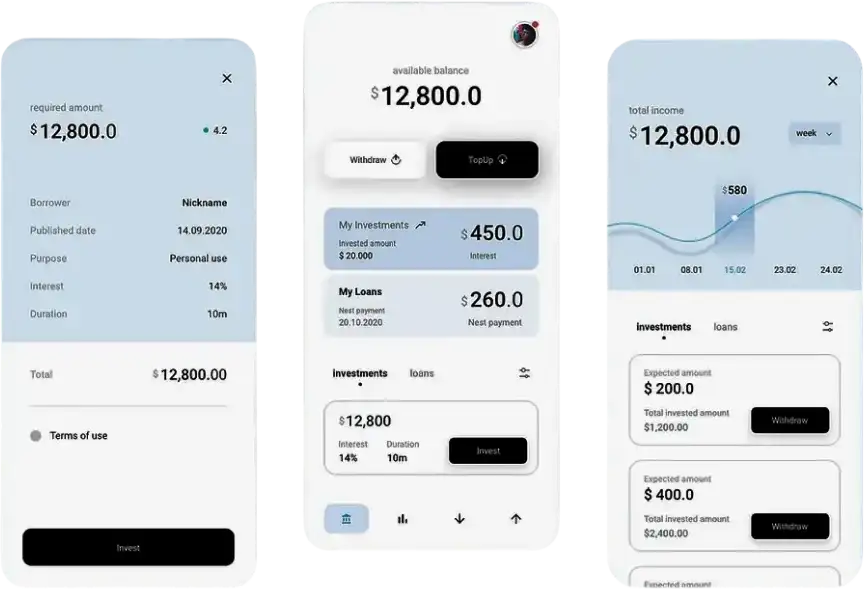

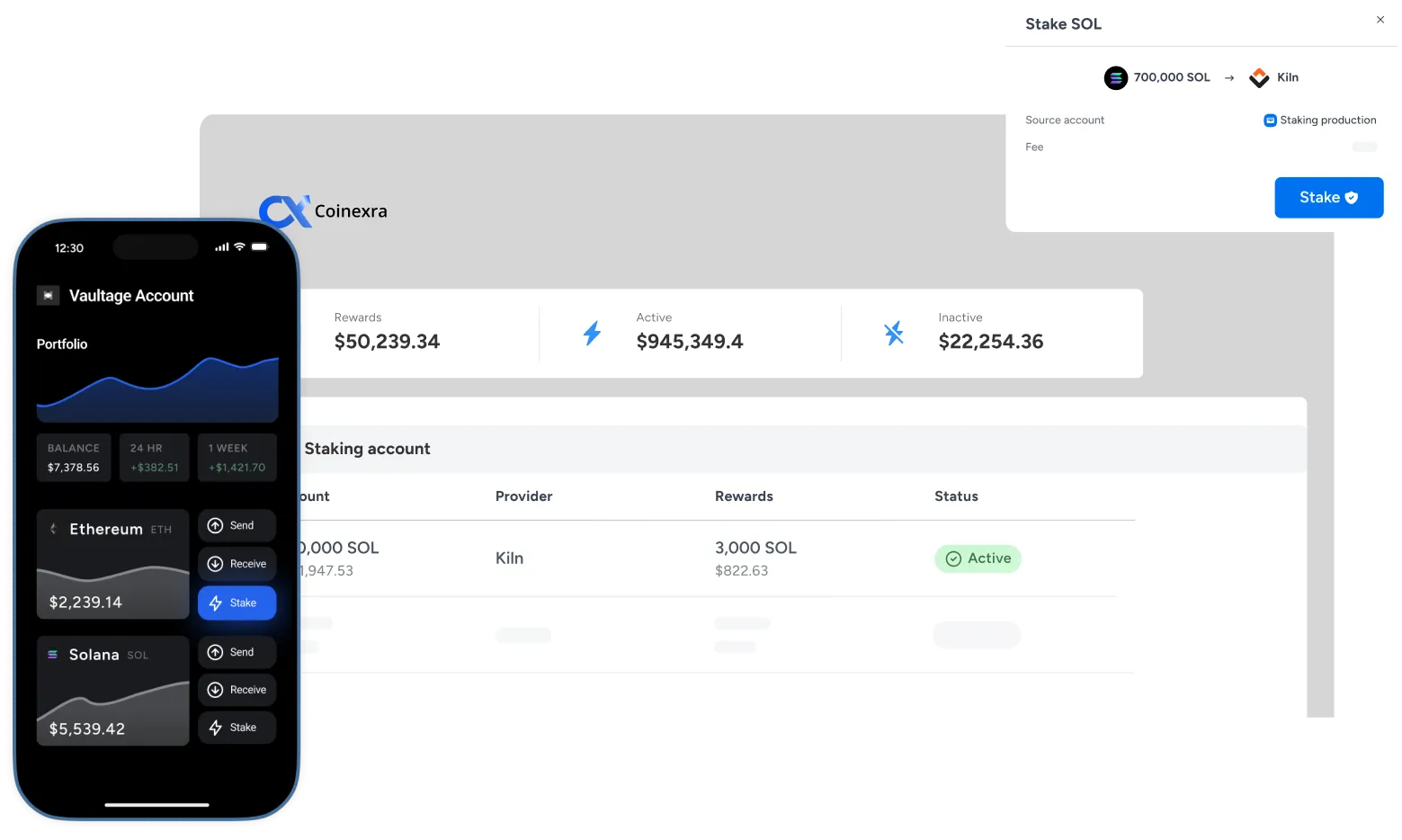

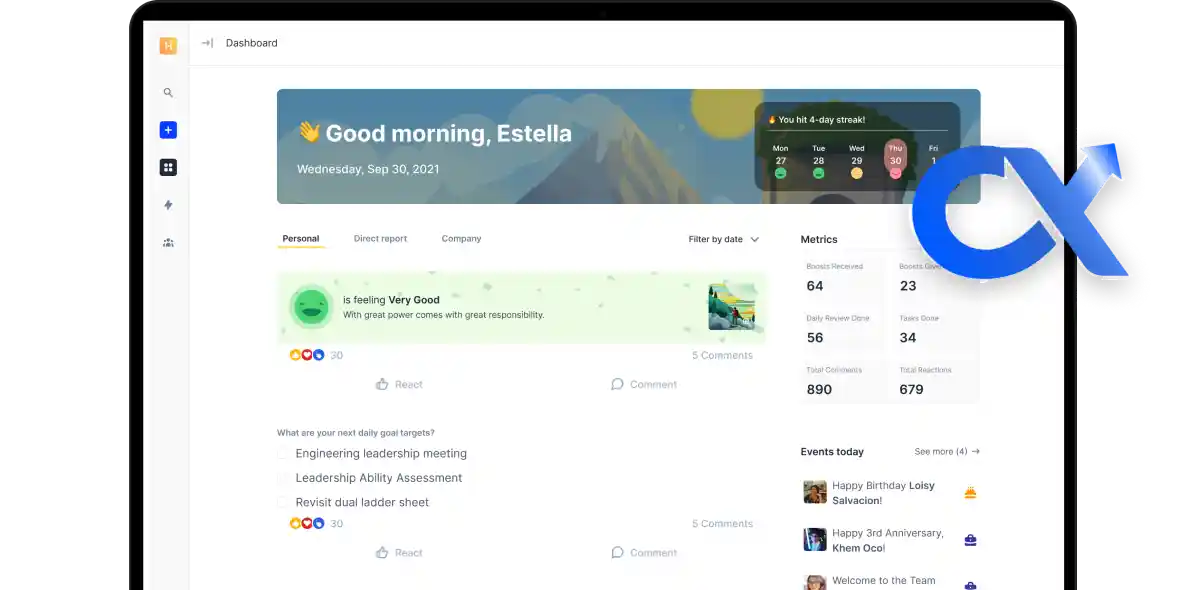

Our solutions are designed to grow with your business. You can start with essential features and later add modules such as lending, staking, loyalty rewards, or new payment methods. This modular structure ensures that you don’t need a complete rebuild, as your platform evolves with your strategy and customer demands.

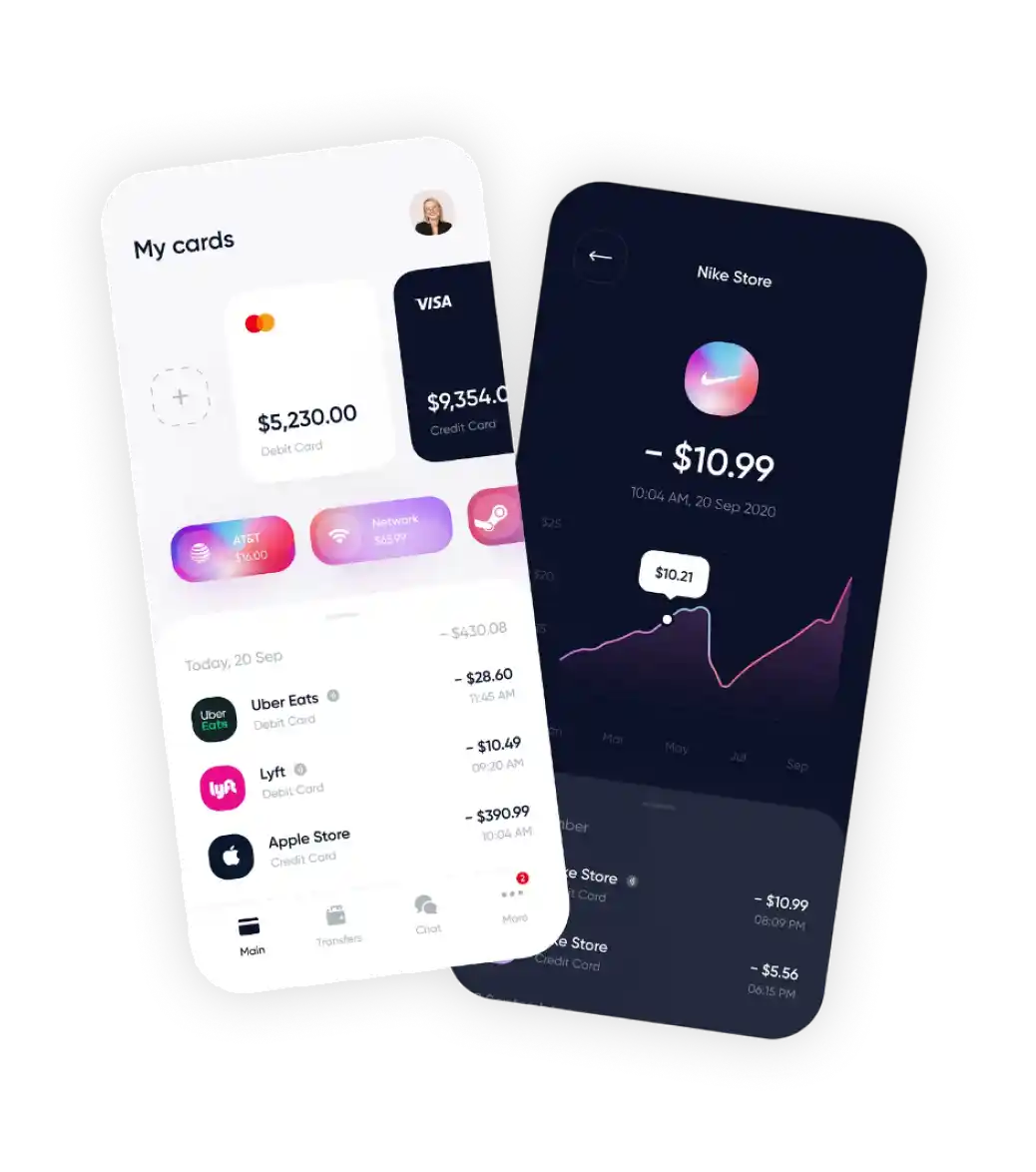

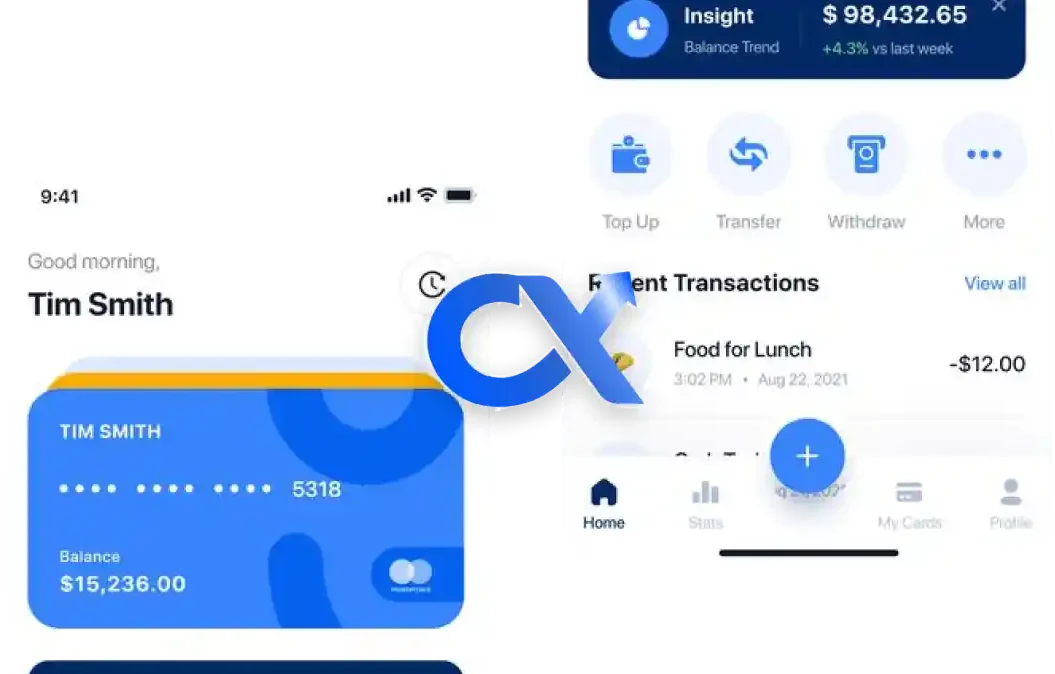

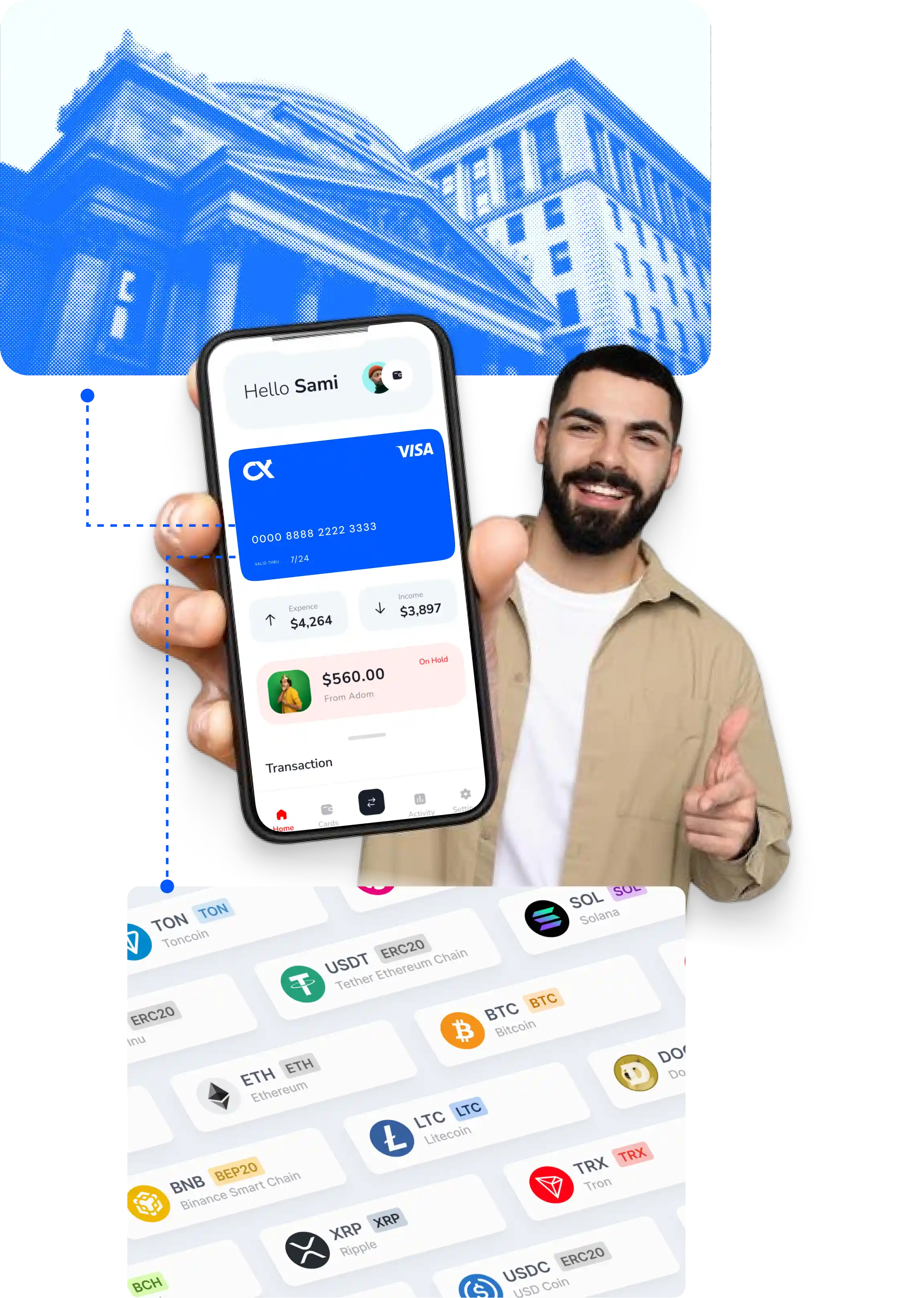

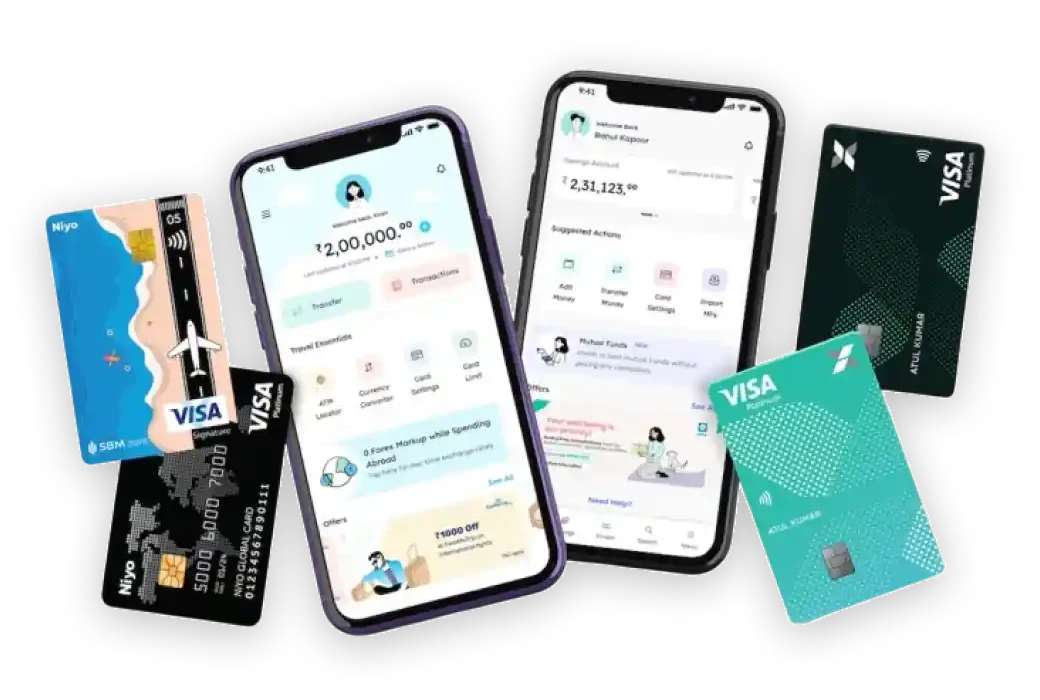

Yes. All our platforms follow a mobile-first design, ensuring smooth experiences across smartphones, tablets, and desktops. This cross-device accessibility means users can manage their finances anytime, anywhere, with consistent performance and intuitive navigation.

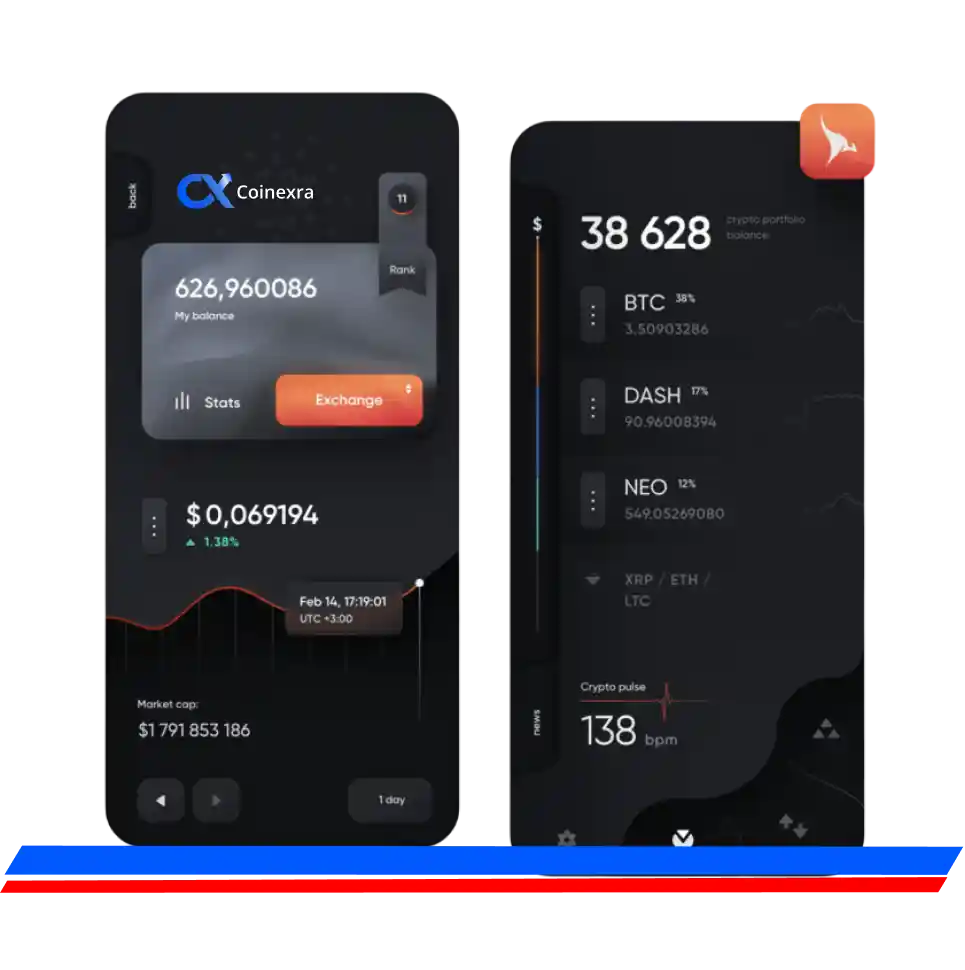

The digital bank platform provides services such as:

- Account opening and management

- Fund transfers and remittances

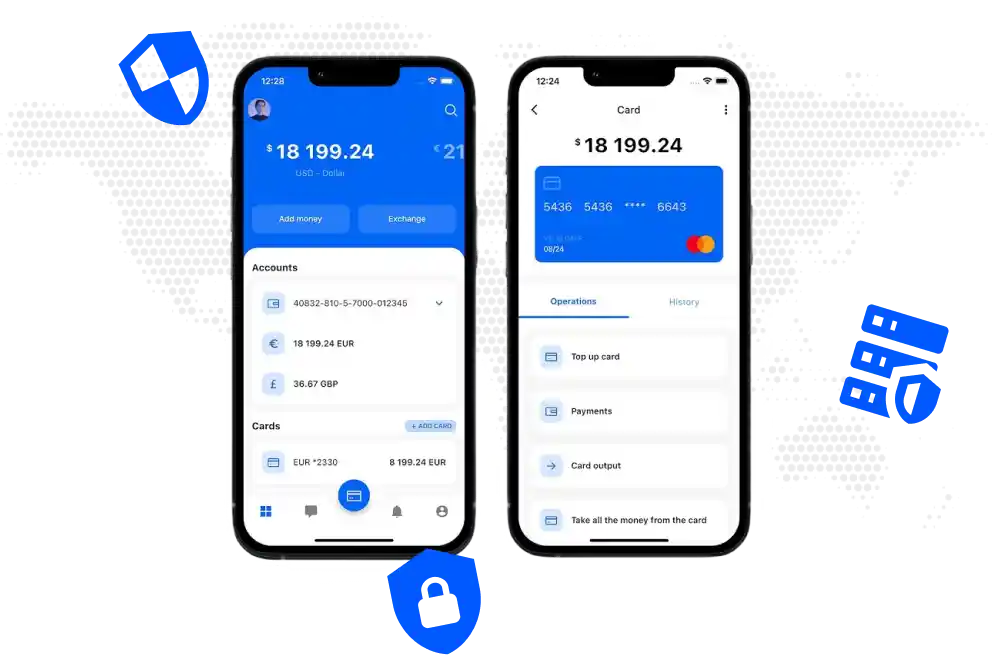

- Card issuance and management

- Interest-bearing accounts

- Automated bill payments

By combining traditional banking functions with modern efficiency, it creates a secure and customer-centric digital banking experience.

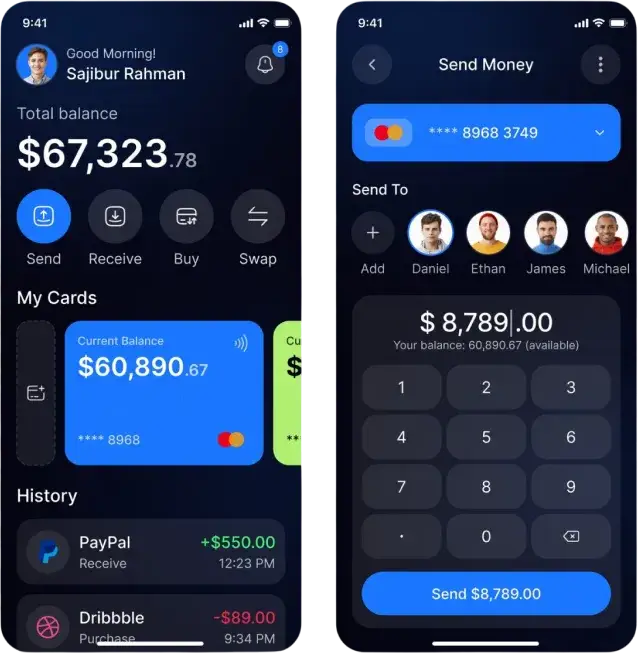

Yes. The neobank platform supports integration with debit and credit card services, allowing businesses to issue physical or virtual cards linked to digital accounts.This enables customers to spend, withdraw, and transact globally, making the neobank a complete alternative to traditional banking.

Neobanks are fully digital, cutting costs by operating without physical branches while offering faster and more affordable services. With instant account setup, real-time transactions, and user-friendly apps, they deliver greater convenience compared to traditional banks.